Staying the course in volatile markets

Investing can play havoc with your emotions. One day the market is up, the next it’s down. With so much volatility, what should you do? The short answer is… nothing! While this might sound counterintuitive, and far easier said than done, history suggests that your investments are better off riding out short-term market volatility. Below are some tips to help you avoid impulsive reactions in volatile markets.

Understand the asset class that you are invested in

It’s a good idea to do as much research as possible on the asset class that you plan to invest in. This will help you understand the extent to which it increases and decreases in value over time. Looking at equities as an example, while this asset class has historically delivered higher returns over the long term, it has also proven to be one of the most volatile. Knowing what to expect beforehand can help you avoid overreacting when the ride gets bumpy.

Looking back at the lessons history has taught us

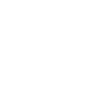

Although past performance is by no means an indication of future performance, looking back at historical returns can reveal some interesting insights. In keeping with our equities example, Graph 1 below shows the number of positive and negative days on the FTSE/JSE All Share Index over a 10-year period (ending September 2016). Given that equities generated a capital return (excluding income distributions) of 8.8% per year over this period, it might seem surprising that it had only 12% more positive days than negative days. What this demonstrates is that negative performance shouldn’t be looked at in isolation as an indication of overall performance. Other factors such as cumulative returns (i.e. the aggregate amount an investment has gained over time) should also be taken into account. It’s important to remember that even though your investment is going through a rough patch, it doesn’t necessarily mean that you are no longer on track to achieve your investment goals. Depending on the asset class that you are invested in, volatility can and should be expected.

Number of Positive & Negative days in Equity Market

10 Years to September 2016

Staying the course is generally a safer bet

Even when you do expect some volatility, watching the value of your investment go up and then down can be uncomfortable. In these instances, it’s a good idea to remember that switching your investment during a period of underperformance not only locks in your losses, it also increases the likelihood of you missing out on future opportunities.

To demonstrate this, Graph 2 below shows the value of an investment on the FTSE/JSE All Share Index over a 10-year period (ending September 2016). The red line shows the difference in returns if you missed the five best-performing days over the period. Worth noting is that the five best days happen to have occurred in the midst of a downward cycle, at a time when many investors would have looked to get out of the market.

The effect of switching at the wrong time

10 Years to September 2016

Riding the ups and downs of the market can make even the most seasoned investors anxious at times. If you feeling nervous when things get a little bumpy, try to remember that you invested with a particular goal in mind and that switching may compromise that objective. To recap, it’s important to understand the asset class that you are invested in; don’t focus too much on negative performance; and stay the course as far as possible; reacting at the wrong time could mean losing out on potential returns.

Prudential unit trusts can play an important role in your success: if you aren’t already investing with Prudential, contact your Financial Adviser.

Prudential’s Brandon Johnson, Retail Business Analyst