When in doubt – Insure

Inform your insurer if your insured property is to be “Unoccupied”!

The contract between you and your insurer is one made in “Good Faith”. Your insurer deserves to be alerted to any changes in the risk associated with the cover provided – and the insured client deserves to be covered for any damages if he/she has done a full disclosure of all the material facts!

What is a significant change in risk – and what would the effect be of property being “unoccupied”?

It does happen from time to time that a property owner experiences changes in his “risk profile”. A rental contract may come to an end and it may take a month or 2 for a new tenant to occupy the premises. When this is a furnished apartment it may well be an attractive target for those wandering the streets, seeing that there is nobody living at that address. [Signs may include no lights at night, a garden neglected, post not collected etc]

What are the duties of the insured property owner in such a scenario?

Insurance contracts usually stipulate what is required when the insured property becomes unoccupied for a specific length of time.

How do we determine if a building is “unoccupied”?

It’s hard to give a generic answer as it depends on the wording of the relevant policy. An “unoccupied” building is a building that is left empty (void of people) for a period of consecutive days. Your insurance policy wording will state how long this period is. It should give a definition of what unoccupied is. Some say that no one is physically present, others that no one is actually living there at all and the place is vacant. Sometimes there is security or staff on the quarters but that also does not always mean the policy defines that as “occupation”.

What are the reasonable steps to take as a client to make sure that they do enjoy cover for Theft and Burglary with signs of visible and violent entry if the building is unoccupied?

If the insurer was notified about the building being unoccupied, because of the additional risk, the client may need to pay an additional premium for theft – or the insurer may decide to exclude theft cover entirely.

Your policy wording will specify whether or not the client would enjoy cover if the insurer was not informed. However, the claim should be evaluated on its own merits and situation. It’s always best to keep your insurer informed!

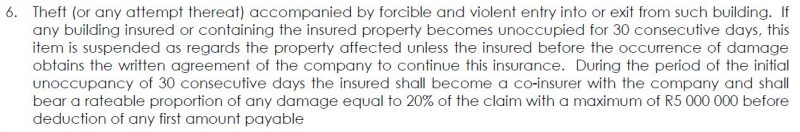

An example of the policy wording is to be found below:

The insured property owner must remember at all times to disclose as much as possible. It is safer to pay a little bit extra for that month or 2 and be fully insured than carry the risk of your insurance claim being rejected on your account of non-disclosure of all the material facts!

When in doubt – Insure

Source : insurancechat.co.za